Homeowner-Driven Virtual Inspections Tool

Double your homeowner completion rate

As proven by a leading insurer, Yembo’s Virtual Inspections Tool for Insurance Underwriting provides live phone support and user-friendly design, delivering the highest homeowner completion rates and speeds. Its native integration with Cotality UnderwritingCenter speeds risk evaluation and reduces costs.

Industry-leading Homeowner Completion Rates

When it comes to transforming the insurance underwriting process, Yembo’s AI-powered Virtual Inspection Tool is setting new benchmarks with industry-leading homeowner adoption rates. Designed to simplify and streamline inspections, our tool provides homeowners with an intuitive, fast, and hassle-free way to complete virtual property surveys. By combining cutting-edge AI with a seamless user experience and real-time phone support, Yembo empowers homeowners to take control of their insurance journey, driving trust and engagement. Discover how our solution is revolutionizing underwriting by delivering exceptional adoption rates and unparalleled efficiency.

Why Yembo for Insurance Underwriting Virtual Inspections

✔️ Double your completion rates and speeds with homeowners compared to similar tools

✔️ Provide real-time support to homeowners to boost satisfaction and completion rate

✔️ Get real-time information and gather up-to-date photos and images

✔️ Reduce your process time with integrations to Cotality UnderwritingCenter

✔️ Outsource your process with peace of mind by leveraging Yembo’s partnerships with boots-on-the-ground providers

✔️ Get additional data points like content inventory with Yembo’s AI technology

Streamline your Underwriting Survey Process

Yembo virtual inspections tool is so quick and easy to use that it has double the adoption rate of other inspections tools

Yembo provides live 24 X 7 phone support, making it simple for homeowners to use and enhancing customer satisfaction

Its native integration with Cotality UnderwritingCenter (previously named CoreLogic Myriad) simplifies your underwriting process and enables you to reduce the time to process

Yembo Workflow for Insurance Underwriting Virtual Inspections

1. Share inspection requests to Yembo easily

Share data in your preferred way - via spreadsheets or via APIs or via native integrations with 3rd party tools like Cotality UnderwritingCenter

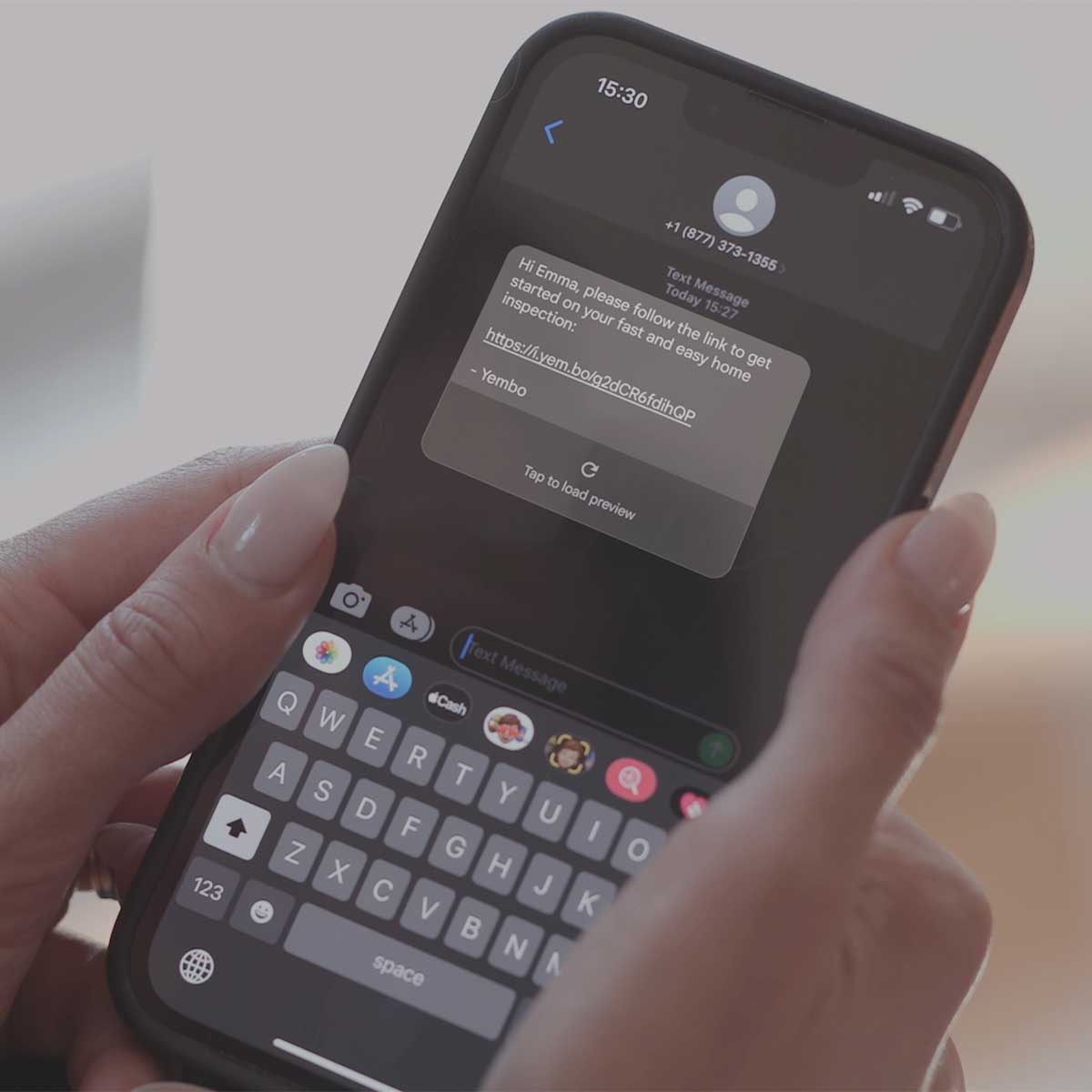

2. Your policyholders are contacted automatically

Automated reach outs will alert policyholders and send reminders via phone calls or text messages

3. Policyholder captures photos & videos to complete virtual inspection

Yembo’s web based interfaced for policy holder is white-labeled with custom branding. No app download required

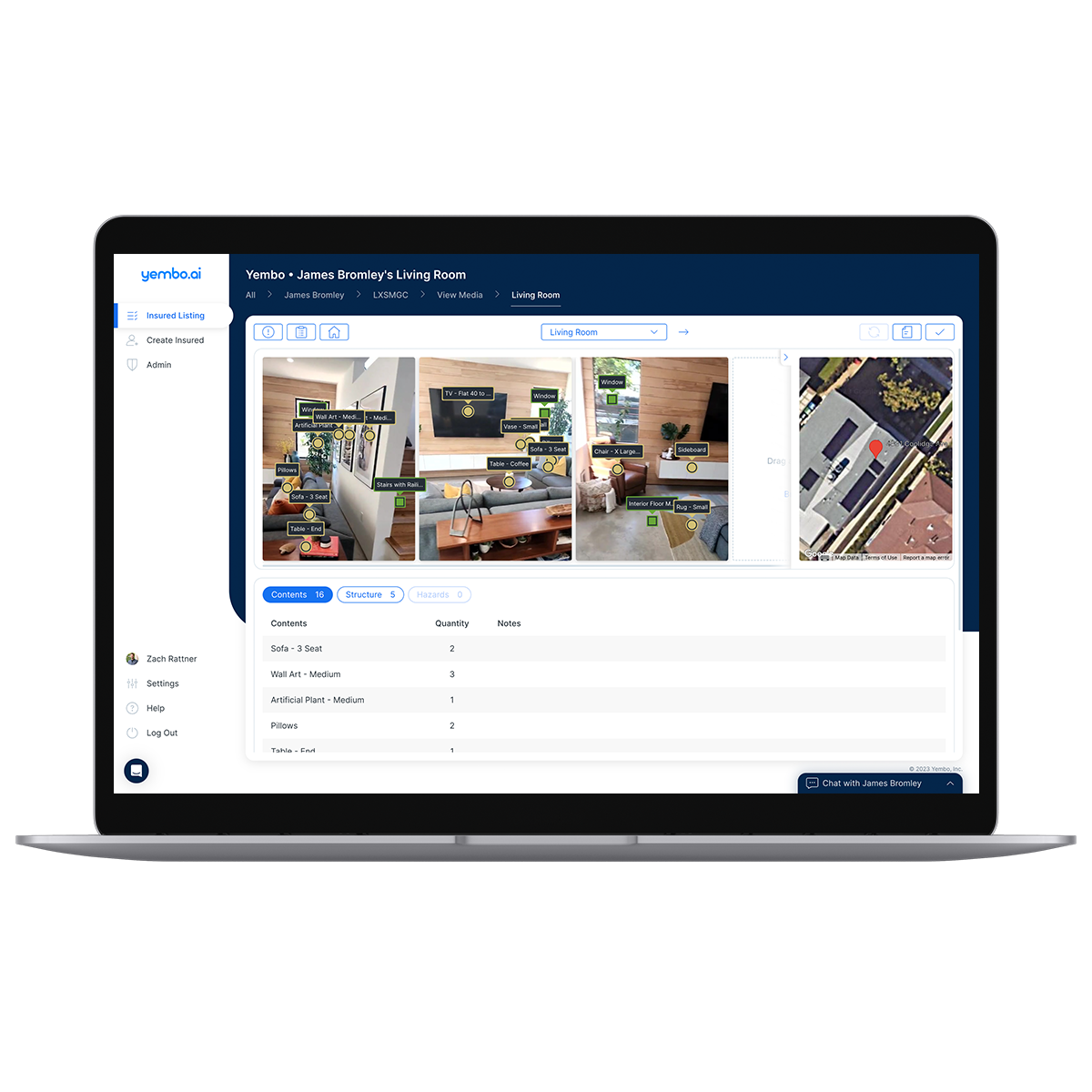

4. View results in the Yembo Hub

Review insights from Yembo’s AI, make updates,

or have Yembo prepare the completed report

5. Receive completed inspection report

Yembo provides the completed Underwriting Report with risks, structure, and contents in a flexible format (PDF, API)

6. Automatic referral to boots-on-the-ground

Yembo can automatically refer incomplete virtual inspections for a physical inspection to multiple boots-on-the-ground vendors

Improve Every Type of Underwriting Inspection

Mainstreet

Yembo’s mainstreet inspection product uses photos of the property’s exterior and interior. Output of Yembo’s leading AI is vetted by experienced professionals to ensure accuracy of identified risks and hazards

High Net Worth

Yembo’s modified high-value inspection product uses photos and videos of the property’s interior and exterior. Output of Yembo’s leading AI is vetted by experienced professionals to ensure ITV accuracy, and reduce risk

of underinsurance

New Policy Acquisition

Grow your written premium accurately by evaluating risks with precision

Renewal

Derisk your existing book by collecting up-to-date data and insights of the property

See How Yembo Also Streamlines Claims Workflows

Yembo ScanMyHome®

Interior scanning tool for claims

Yembo’s AI-powered ScanMyHome™ claims adjuster software creates 3D models and floor plans in minutes from any smartphone, leveraging proprietary AI Point and Scan™ technology. Outputs are ready in Xactimate® within minutes.

Yembo for Claims Packouts

Yembo's AI-powered claims packouts tool simplifies the process, enabling non-experts to perform video surveys that quickly generate accurate visual inventories, leading to faster, more precise estimates while reducing costs and saving time.